Why Your Fund Marks Are Useless for Decision-Making (And What to Do About It)

Your Q1 NAV statement arrives in October. It shows March 31st data. It's now October 22nd.

You're making commitment decisions today with data from 7 months ago.

This isn't a complaint. It's just the reality of private markets. GPs need time to:

- Collect portfolio company valuations

- Close their books

- Get auditor sign-off

- Compile reporting packages

- Send to LPs

By the time you see the marks, they're ancient history.

The Problem: Stale Marks Kill Fast Decisions

Real scenario from a $1.2B family office:

"A GP we've worked with for 10 years calls Friday morning. They have a $15M co-investment opportunity in a company we love. They need an answer by Monday."

"Our latest marks are from Q1. It's Q4. We have no idea what our actual NAV is. We don't know if we have capacity. We're guessing."

This family office said yes (they trusted the GP). The deal worked out. But it was a $15M decision made with gut feel, not data.

Why This Matters More Than You Think

Stale marks create 3 critical problems:

1. You Don't Know Your Current Portfolio Value

Example:

- Your Q1 NAV: $500M (as of March 31)

- You received $20M in distributions in Q2

- You sent $30M in capital calls in Q2

- You sent $15M in capital calls in Q3

- What's your NAV now? You have no idea.

You could do the math manually:

$500M - $20M (distributions) + $30M (Q2 calls) + $15M (Q3 calls) = ~$525M?

But this ignores:

- Portfolio company growth (or decline) since March

- FX rate changes (if you have multi-currency funds)

- Fee accruals

- Dividend accumulations

- Partial exits

Your actual NAV could be 540M. You're flying blind.

2. You Can't Answer "Can I Commit?" Quickly

GP calls with $10M opportunity. You need to know:

- Current portfolio NAV (you don't know—marks are stale)

- Unfunded commitments across all funds (you have this)

- Expected capital calls next 6-12 months (you're guessing)

- Expected distributions next 6-12 months (also guessing)

- Allocation impact (calculated from stale NAV = wrong)

Traditional answer: "Let me get back to you in 3-5 days while I rebuild my model."

By then, the opportunity is gone.

3. You're Optimizing for Last Quarter, Not Next Quarter

What you're actually doing when you use stale marks:

You're making forward-looking decisions (future commitments) based on backward-looking data (ancient marks).

It's like driving by looking in the rearview mirror.

Yes, you can see where you've been. But you can't see where you're going.

What Forward-Looking Family Offices Do Instead

The solution isn't "get marks faster." (You can't—GPs need time.)

The solution is project forward from your latest marks.

The Blended Approach

Start with: Latest NAV marks (even if 6-9 months old)

Blend with: Actual transactions since last mark:

- Capital calls (you know exactly when these happened)

- Distributions (you know exactly when these happened)

- Management fees (calculated based on fund terms)

Project to: Current NAV estimate based on:

- Fund-level growth assumptions (based on fund type and stage)

- Portfolio company performance (if you have visibility)

- Exit activity (if any portfolio companies have exited)

Result: Current portfolio view (not 6-9 months stale)

Real Example: Before vs. After

Before (Stale Marks):

- Q1 NAV: $500M (as of March 31, received in October)

- Can we commit $10M? "Let me build a model for 3 days"

After (Blended View):

- Q1 NAV: $500M (as of March 31)

- Q2 transactions: -30M calls, -8M net

- Q3 transactions: +1.5M fees = +$13.5M net

- Projected growth since Q1: +$12M (2.4% quarterly growth assumption)

- Current NAV estimate: ~$533.5M (as of today)

- Can we commit $10M? Answer in 30 seconds: "Yes, capacity available"

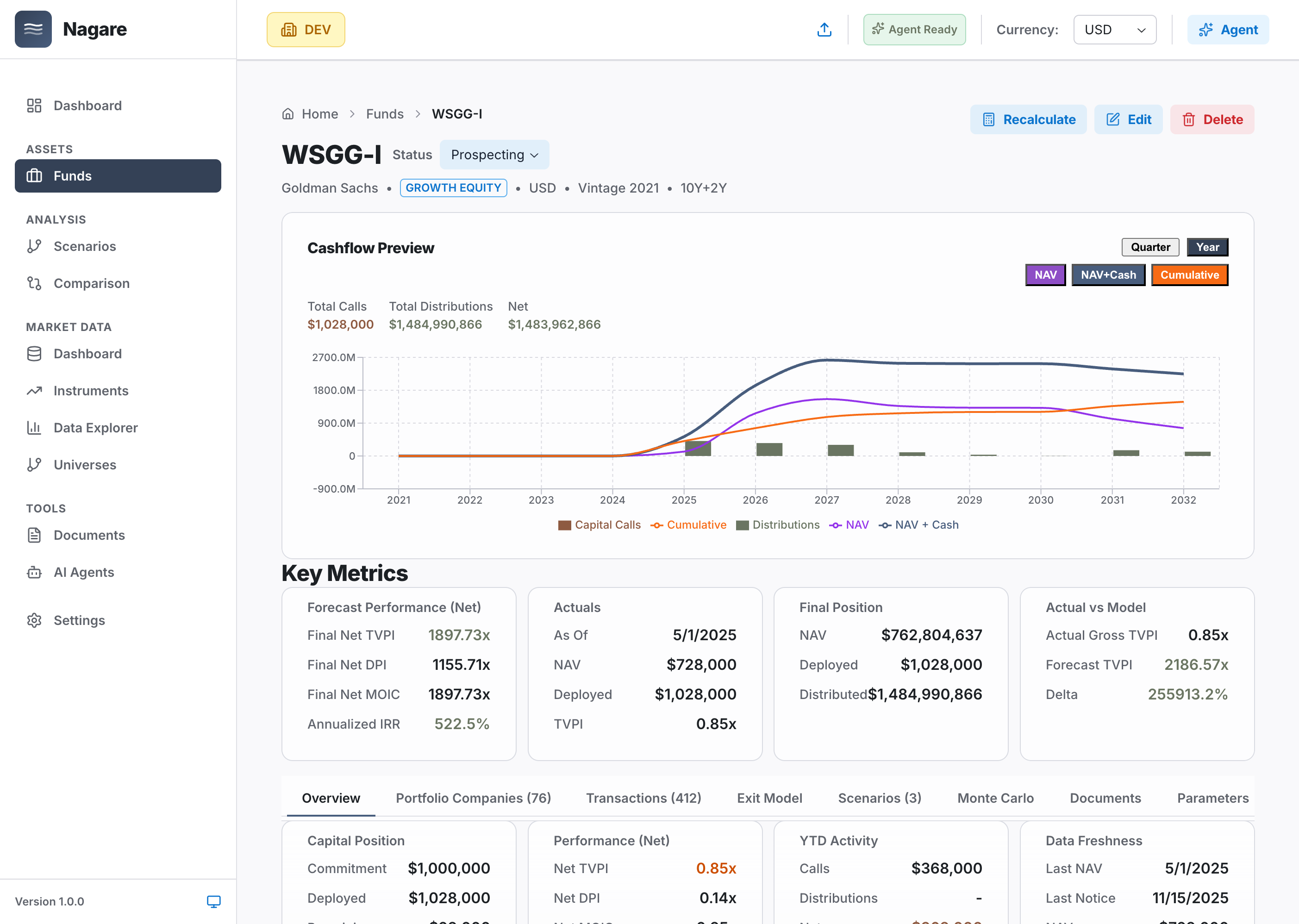

Fund-level tracking: See capital position, distributions, net cashflow, and data freshness

Fund-level tracking: See capital position, distributions, net cashflow, and data freshness

How This Works in Practice

Step 1: Track ALL Transactions

Don't just record transactions when marks arrive. Track them as they happen:

- Capital call on June 15: -$5M

- Distribution on July 22: +$8M

- Management fee on Sep 30: -$0.5M

Step 2: Project to Current

For each fund, apply fund-level growth assumptions:

- VC early-stage funds: 8-12% quarterly growth (aggressive)

- Growth equity funds: 4-6% quarterly growth (moderate)

- Buyout funds: 3-4% quarterly growth (stable)

- Real estate funds: 2-3% quarterly growth (steady)

- Credit funds: 1-2% quarterly growth (stable income)

These aren't perfect. But they're better than assuming NAV = last mark (which assumes 0% growth since March).

Step 3: Adjust for Known Events

If you know a portfolio company:

- Raised a new round at higher valuation → bump NAV for that fund

- Had a down round → reduce NAV for that fund

- Exited → adjust for exit proceeds

Most LPs don't have this visibility. But if you do, use it.

Step 4: Calculate Current Capacity

Now you can answer:

- What's my current NAV? (projected, not stale)

- What are my unfunded commitments?

- What capital calls are expected next 6 months?

- What distributions are expected next 6 months?

- Can I commit $10M? (Real-time answer)

The Tools You Need

Option 1: Enhanced Excel (Manual Projection)

Add a "projection" tab to your Excel model:

- Latest NAV marks (Q1)

- Actual transactions since last mark (Q2-Q4)

- Growth assumptions per fund

- Calculated current NAV

Pros: You can build this yourself Cons: Breaks at 15-20 funds, manual updates, error-prone

Option 2: Purpose-Built Software (Automated Projection)

Use software designed for forward-looking private fund forecasting:

- Automatically blends actuals + projections

- Applies fund-level growth assumptions

- Updates current NAV in real-time as transactions come in

- Answers "Can I commit?" in seconds

Pros: Scales to 50+ funds, automatic, reliable Cons: Costs money (but saves 40+ hours/quarter in manual work)

Common Objections Addressed

"Isn't this just guessing?"

Yes—but it's informed guessing, which is better than blind guessing.

When you use stale marks (Q1 data in October), you're implicitly assuming:

- Zero growth since March

- Zero change in valuations

- Zero impact from transactions

That's also guessing. And it's probably wrong.

Projecting forward with growth assumptions is more realistic.

"GPs will think I don't trust their marks"

You're not replacing GP marks. You're projecting between marks.

When Q2 marks arrive, you update your projections with actuals. You're always working from the latest GP-provided data—you're just not waiting 6-9 months frozen.

"What if my projections are wrong?"

They will be. That's fine.

The point isn't perfection. The point is making better decisions than flying blind.

If your projected NAV says 520M, you were 2% off. That's way better than assuming NAV = $500M (March marks), which was 4% off.

"This sounds complicated"

It's actually simple:

Current NAV = Last Mark + Transactions Since Mark + Estimated Growth

That's it.

The only "complicated" part is applying reasonable growth assumptions. But you already do this mentally when evaluating new funds. Now you're just applying it systematically.

What You Should Do Next

If you're managing 10+ private funds and making commitment decisions based on stale marks, you have 3 options:

1. Keep Flying Blind (Not Recommended)

Continue using 6-9 month old marks for current decisions. Accept that you're making $10M+ decisions with ancient data.

2. Build Your Own Projection System

Add a "blended view" to your Excel model:

- Track all transactions as they happen

- Apply growth assumptions per fund

- Calculate current NAV estimate

Time investment: 2-3 days to build, 2-4 hours/quarter to maintain

3. Use Purpose-Built Software

Use software that does this automatically:

- Import latest marks from GP statements (AI extraction)

- Track transactions as they happen

- Apply fund-level growth assumptions

- Show current NAV + where you're heading

Time investment: 1-2 days to set up, 15 minutes/quarter to maintain

The Bottom Line

Your Q1 marks arrived in October showing March data.

That's just how private markets work. You can't change it.

But you don't have to make commitment decisions with 9-month-old numbers.

Forward-looking family offices project to current.

They blend:

- Latest marks (even if stale)

- Actual transactions (capital calls, distributions)

- Fund-level growth assumptions

- Current NAV estimates

Result: They can answer "Can I commit $10M?" in 30 seconds, not 3 days.

They're not guessing. They're using informed projections based on the best available data.

And when Q2 marks arrive, they update their projections with actuals. Rinse and repeat.

That's the difference between reactive portfolio management and forward-looking portfolio intelligence.

How Nagare Helps

Nagare is built specifically for forward-looking private fund forecasting:

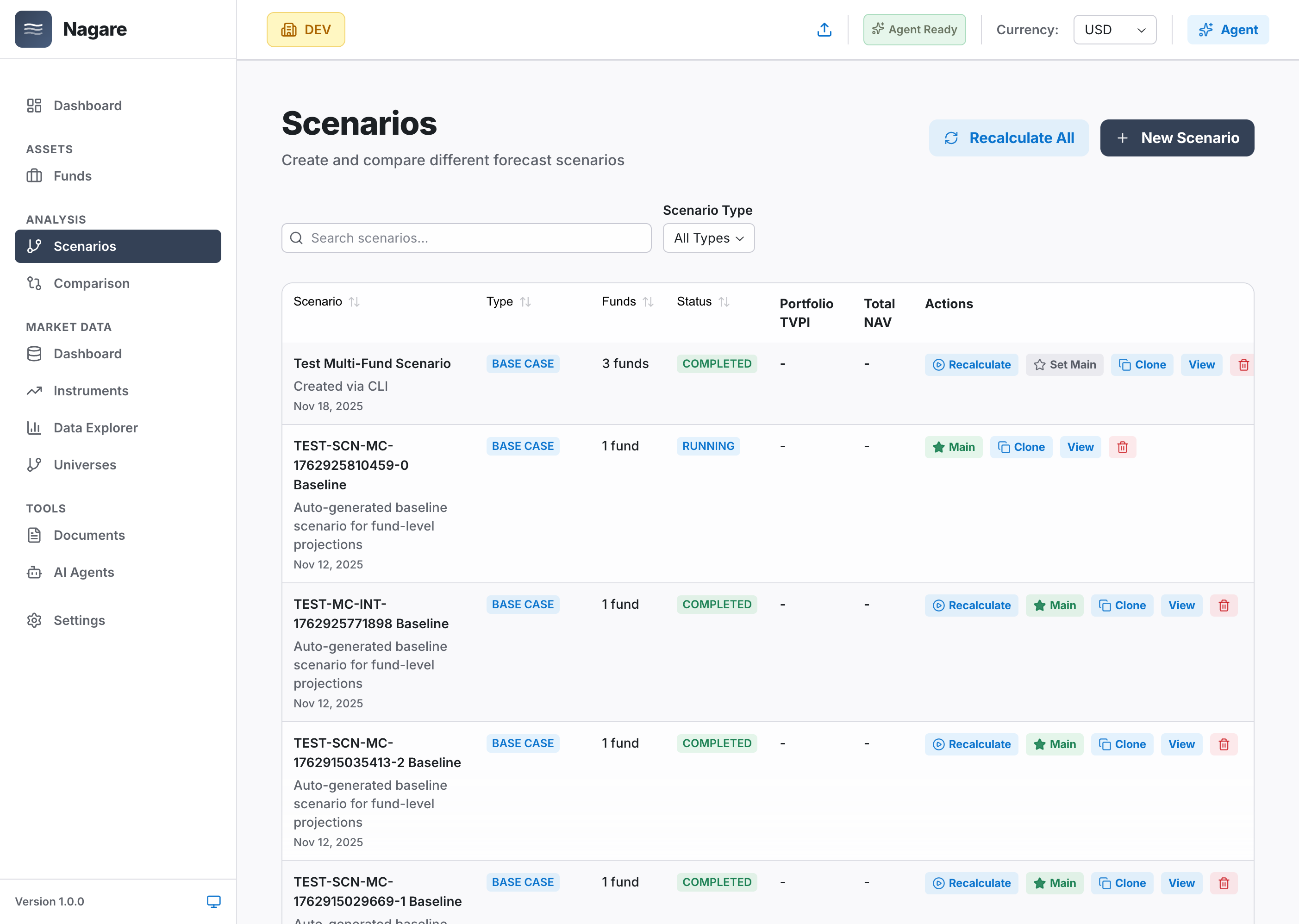

Model multiple scenarios to see different portfolio outcomes: Base Case, Bull Case, Bear Case, Stress Test

Model multiple scenarios to see different portfolio outcomes: Base Case, Bull Case, Bear Case, Stress Test

Blended Actuals + Projections:

- Start with latest marks (from GP statements)

- Add all transactions since last mark

- Project to current with fund-level assumptions

- Always see where you are TODAY + where you're heading

30-Second Commitment Modeling:

- GP calls with $10M opportunity?

- Model the impact in 30 seconds

- See NAV impact, cashflow changes, allocation shifts

- Answer by Friday = same day

Forward-Looking Liquidity:

- Know exactly when you'll need $30M for capital calls

- Plan 2+ years out

- No more liquidity surprises

Built for family offices managing 20-60+ private funds who need to make fast, confident commitment decisions.

Ready to see what forward-looking looks like? Request a demo

See it in action: Schedule a demo

Related Reading:

Ready to Transform Your Portfolio Management?

See how Nagare can eliminate manual work and accelerate decision-making.

Related Articles

The $2M Reconciliation Error That Changed How We Think About Cash

A single missed transaction created a $2M hole in a client's cash forecast. We rebuilt our system so it can never happen...

Stop Chasing Spreadsheets: Introducing Agent Schedules

Manual portfolio monitoring at scale is impossible. Our new Agent Schedules feature deploys 6 AI agents that run 24/7, c...